Farmville tax rate set to increase, proposed budget submitted

Published 10:44 am Monday, April 7, 2025

|

Getting your Trinity Audio player ready...

|

A proposed budget has been submitted for the Town of Farmville. Now council members have to decide if they want to keep it as is, make cuts or change the proposed tax rate. Those decisions don’t have to be made this week. First, there will be a public hearing Wednesday, April 9 about the proposed changes to the Farmville tax rate. Then the council will hold a hearing on the overall budget next month.

The proposed Farmville tax rate

Since the proposed tax rate is what the public hearing is for Wednesday, let’s start there. Currently, the Farmville tax rate stands at 13 cents per $100 of assessed value. A penny on the tax rate in this decision roughly adds up to $80,000. By comparison when looking at similar sized towns, Brookneal stands at 17, Blacksburg and South Boston are at 26 cents, Bedford is at 28, Crewe is at 30 and South Hill stands at 31.

The Farmville tax rate has moved around several times over the last 28 years. It stood at 14 cents per $100 of assessed value in 1997, then dropped to 10 cents in 2009, before rising to 12 cents in 2011. It bumped up to 13 cents in 2021.

The proposal would see the tax rate increase to 22 cents, up from 13. That would help address the current $1.3 million shortfall and balance the budget, allowing the council to keep all of the requested projects in.

Farmville Town Manager Dr. Scott Davis told the council during their Wednesday, April 2 meeting that the proposed budget is built around the 22 cents pert $100 of assessed value rate.

“We do know that could change,” Davis said. “[But] if that (tax rate) changes, the budget changes.”

Turning to the budget

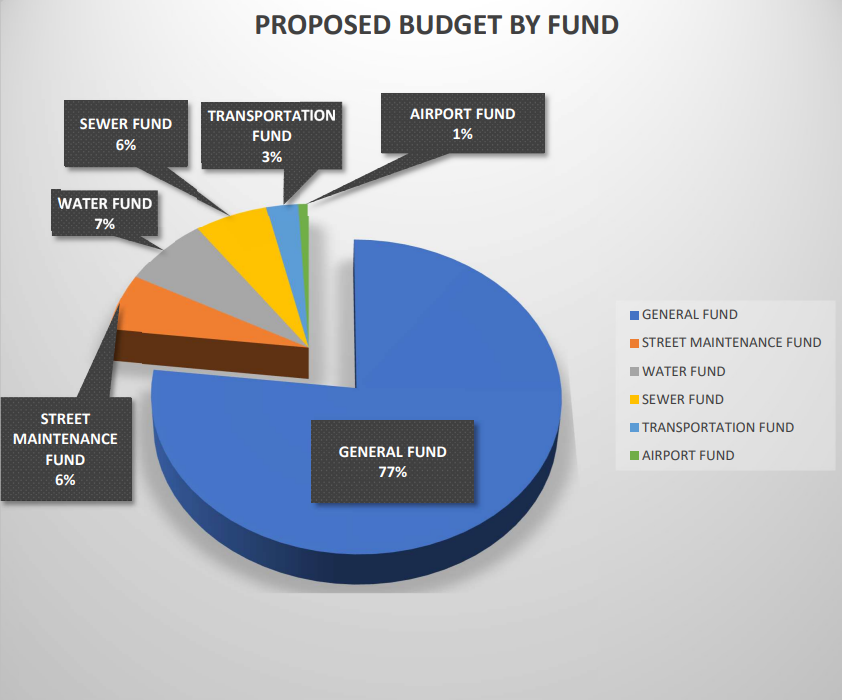

Now let’s look at the actual proposed budget. Farmville Town Manager Dr. Scott Davis submitted a budget of $43,367,489. That consists of $33,341,990 in the general fund; a total of $2,621,672 in the street maintenance fund; $3,176,458 in the water fund; $2,688,059 in the sewer fund; $1,159,745 in the transportation fund and $379,565 in the airport fund. Davis also mentioned as part of the budget, he’s proposing a $16 million general obligation bond to fund the renovation and expansion of the fire department building and to purchase a new ladder truck.

“Despite as we know the challenges we have economically, including inflationary pressures, Farmville still remains in a strong financial position,” Davis told the council during their Wednesday, April 2 meeting. When he first came to town, Davis pointed out, any general fund budget holes were always filled by taking money from the enterprise funds, the sewer and water fund. Now this proposed budget will be the second one with no money transferred from the water or sewer fund to cover the general fund shortfalls.

What would the Farmville tax rate cover?

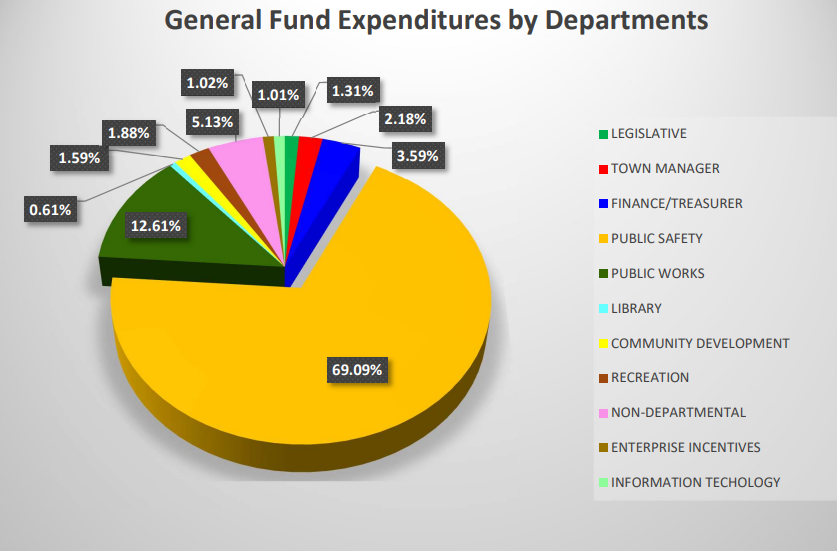

The biggest requests in the budget come from public safety, which covers emergency communications, fire and police. Requests from this area add up to roughly 69% of the budget.

Town staff want to spend $956,000 to make a series of purchases. That includes $231,000 for five police cars; $75,000 for graphics and outfitting for those cars; $60,000 for a new emergency medical services (EMS) vehicle; $25,000 to outfit the EMS vehicle; $180,000 for a tractor/mower to mow the right-of-way on the street; $80,000 for a pickup with a lift gate; $225,000 for a dump truck and $80,000 for a ¾ ton utility truck.

The tractor mower is one of the major needs, Davis said, as the current one has a 20-year-old clutch that could go out at any time. Also, the fire department requests permission to add a full-time firefighter position.

“The reason for that is one additional position will allow us to have 24-hour service at the station,” Davis told the board. “That is something we discussed several years ago.”

The budget, as mentioned above, also includes the $16 million bond request to renovate the fire department. Built in 1991, there are no living quarters in the station. The women’s bathroom doesn’t have a shower, the firefighters sleep in the meeting room and do any decontamination in the apparatus bay. This renovation would mean building bunk rooms, shower rooms and laundry rooms. The gear would be stored in a separate room, one that’s constantly ventilated.

This $11 million renovation would be done in phases. Phase One would involve building the support areas, then an expansion of the parking lot to the rear. This would allow the department to move supplies out of the existing building. Phase Two would involve developing the shell outside construction around the existing building. Once that’s done, you can finish the interior renovation, upgrade the apparatus bay and do any final paving. This is estimated at a 12-14 month project. The $16 million bond cost is set up to cover any future inflation or additional funding increases that pop up during construction.

Along with the fire department costs, the budget currently includes a request to allow a promotion, turning the finance director position into a deputy town manager role. There’s also the proposed fitness park, which comes in at roughly $274,000. Back in December, the council agreed to partner with the National Fitness Campaign (NFC) program to build a fitness court in town.

Needs versus wants

The only council member to ask questions or float potential alternatives to a tax rate increase to cover the $1.3 million shortfall was John Hardy, who offered several ideas. He asked if instead of a property tax rate increase, could the town increase its meals tax? Hardy estimated that increasing the meals tax by half a percent, 50 cents extra on $100 of food, could generate $300,000. That’s equivalent to four cents on the property tax rate, he pointed out.

Also, Hardy asked about increasing the lodging tax. Farmville currently has a 7% lodging tax. Some cities and counties charge way more, as much as 11%, he pointed out. Some even charge an additional $1, $2 or even $3 per night per occupied room. He estimated raising the lodging tax from 7% to 10% could generate another $300,000 to $320,000, further reducing the need to raise the property tax rate.

“We have another thing we need to think about, it’s our spending and what we’re spending on,” Hardy said. “And I know, I realize there’s some things we kinda need. We may not always be able to get everything that we need or want. We may have to put some stuff off.”

For the firehouse, Hardy questioned if the town really needed $11 million in improvements?

“Can we downsize that to save a significant amount of money and still achieve our long term goals?” Hardy asked. “Where is this going to put us with this firehouse 10, 20, 30 years down the road?”

Hardy also pointed out that last time the town bought a firetruck, Longwood University contributed about $250,000, roughly 25%. He questioned if Longwood could contribute this time as well.

Meals, lodging increases possible

Davis responded that it was possible to raise the meals and lodging taxes, however he would advise against relying on funding options like that which could shift with the seasons. One month the hotels may be packed due to Longwood and Hampden-Sydney basketball and then in another month, they could be only half full.

Davis also cautioned about asking departments to make any further cuts in their budget, as that could impact the services they provide for residents.

Farmville Mayor Brian Vincent agreed that it might not be a good idea to rely on shifting taxes like meals and lodging.

“We all saw during COVID that being overly reliant on variable taxes can sometimes sting you,” Vincent said. “(The) recreational fitness court is an easy cut, it’s not a need.”

Vincent also just floated the idea of possibly getting money back from the town’s industrial development authority (IDA). After Farmville sold the town golf course, some money was loaned to the IDA with the thought it would help generate business and job growth.

“At that point, there was a gameplan for it, but that gameplan has not come to fruition,” Vincent pointed out.

Davis responded that the IDA would have to give the money back. The town council can’t demand it.

Farmville tax rate hearing set for Wednesday

Overall, Vincent said Farmville isn’t the only municipality in Virginia dealing with these issues. He cautioned about postponing projects or purchases too long, as that’s also come back to bite other towns and counties.

“It is not unique to us,” Vincent said. “Budgetary issues are not unique to us. I’ve seen a lot of towns in Virginia who have had a lot of deferred infrastructure maintenance that is starting to weigh on them heavily and they don’t have the money to do it.”

The public hearing for the proposed tax rate of 22 cents per $100 of assessed property value will be held this Wednesday, April 9. That’ll take place at 6 p.m. at town hall, located at 116 N. Main Street.